Odoo FBR Integration - Odoo POS FBR Integration in Pakistan

Integrating your Odoo Point of Sale (POS) system with the Federal Board of Revenue (FBR) in Pakistan ensures compliance with tax regulations while streamlining business operations. At ManTech IT, we specialize in delivering tailored Odoo FBR integration solutions to help Tier-1 retailers, restaurants, and small businesses automate tax reporting, reduce manual work, and stay compliant. This guide explains what Odoo FBR integration is, why it matters, how it works, and how to implement it effectively.

What is Odoo FBR Integration?

Odoo FBR integration connects your Odoo POS system to the FBR portal, enabling real-time sales reporting and automated tax compliance. The Federal Board of Revenue (FBR), Pakistan’s central tax authority, mandates that certain businesses, particularly Tier-1 retailers, integrate their POS systems to report sales data instantly. This ensures accurate tax collection and reduces tax evasion.

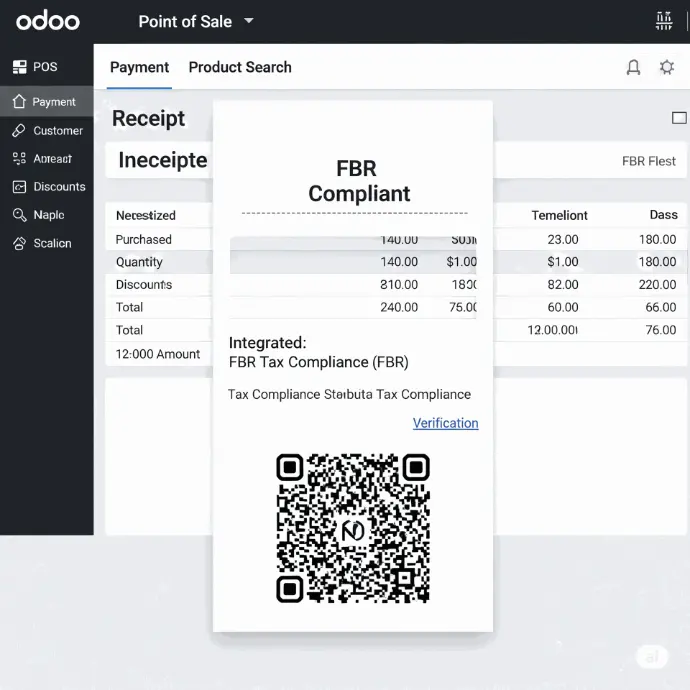

Odoo, a powerful open-source ERP platform, offers modules like the Odoo POS FBR Connector to simplify this process. It automates invoice generation, syncs sales data with FBR, and generates compliant receipts with unique FBR invoice numbers and QR codes.

Why is FBR POS Integration Important for Pakistan Businesses?

FBR POS integration is mandatory for Tier-1 retailers in Pakistan, as outlined in the Sales Tax General Order (STGO) No. 17 of 2022. Non-compliance can lead to a 60% reduction in input tax adjustments, hefty fines, or legal penalties. Beyond compliance, integration offers several benefits:

- Real-Time Tax Reporting: Sales data is sent to FBR instantly, eliminating manual tax filings.

- Error Reduction: Automated processes minimize human errors in tax calculations.

- Time Savings: Streamlines invoicing and reporting, freeing up time for business growth.

- Customer Trust: Receipts with FBR-generated QR codes enhance transparency and credibility.

- Scalability: Supports multi-branch setups, ideal for growing retail chains.

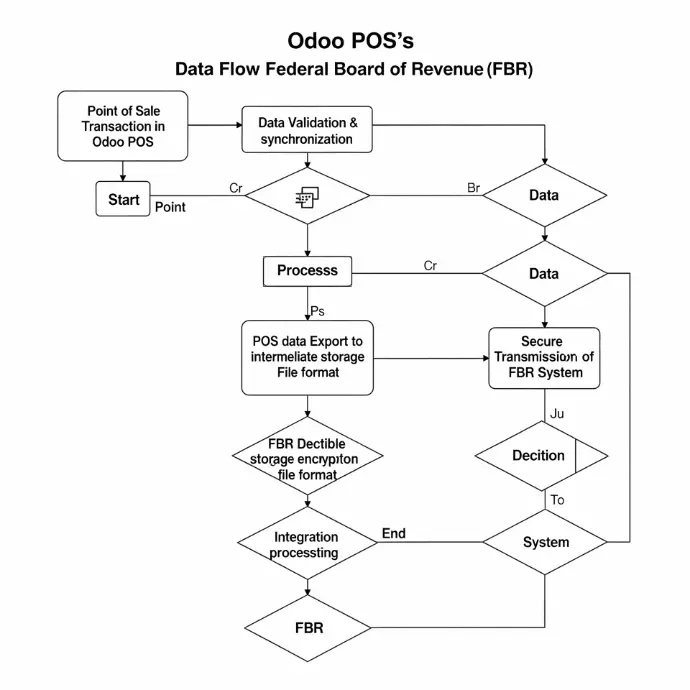

How Does Odoo POS FBR Integration Work?

Odoo POS FBR integration automates the flow of sales data to the FBR portal. Here’s how it works:

- Customer Places an Order: A customer completes a purchase through your Odoo POS system.

- Invoice Creation: Odoo generates an invoice with all necessary details, including products and taxes.

- FBR Invoice Number Request: The system sends order details to the FBR portal via API.

- FBR Invoice Generation: FBR assigns a unique invoice number and QR code.

- Receipt Printing: The POS receipt includes the FBR invoice number and QR code, verifiable via the FBR Tax Asaan app.

- Data Synchronization: Sales data is synced with FBR for tax reporting.

- Error Handling: If connectivity issues occur, a cron job or manual resend ensures data is posted later.

Key Features of Odoo POS FBR Integration

Odoo’s FBR integration module offers robust features to ensure compliance and efficiency:

- Automatic Data Sync: Sends POS order details to FBR upon payment completion.

- Refund Handling: Processes returns and refunds, syncing them with FBR.

- Cron Job Support: Automatically retries failed syncs due to connectivity issues.

- PCT Code Integration: Supports Pakistan Customs Tariff (PCT) codes for accurate tax reporting.

- Multi-Language Support: Includes English, Urdu, and other languages for receipts.

- QR Code Generation: Adds verifiable QR codes to receipts for compliance.

- Filtering Options: Easily track successful or failed FBR syncs.

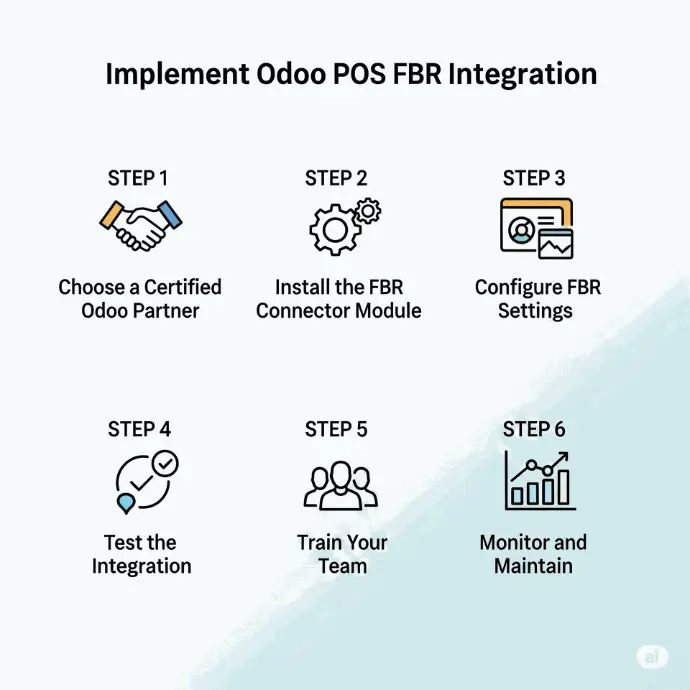

Steps to Implement Odoo POS FBR Integration

Setting up Odoo POS FBR integration is straightforward with the right guidance. Follow these steps:

Step 1: Choose a Certified Odoo Partner

Work with a trusted Odoo partner like ManTech IT to ensure seamless integration. Certified partners understand FBR requirements and Odoo configurations.

Step 2: Install the FBR Connector Module

Download a reliable module, such as the “sh_pos_fbr_connector” from the Odoo Apps Store. Ensure compatibility with your Odoo version (e.g., Odoo 16 or 17).

Step 3: Configure FBR Settings

- Enable the FBR Connector in Odoo.

- Set up FBR authentication (sandbox or production mode).

- Add your company’s STRN/NTN and POS ID.

- Configure header authorization and logo for receipts.

- Assign PCT codes to products for tax compliance.

Step 4: Test the Integration

Run test transactions to verify that invoices sync with FBR and receipts display the correct invoice number and QR code. Check FBR logs for successful or failed syncs.

Step 5: Train Your Team

Train staff on using the integrated POS system, handling refunds, and troubleshooting connectivity issues. ManTech IT offers training and ongoing support.

Step 6: Monitor and Maintain

Use Odoo’s FBR log menu to track sync status. Schedule cron jobs to handle failed syncs automatically. Regularly update the module for compatibility and security.

How Odoo FBR Integration Works: A Step-by-Step Process

The integration of Odoo with the FBR system is a straightforward process that ensures seamless data flow and compliance. Here’s a simplified breakdown of how it works:

- Customer Transaction: A customer makes a purchase at your retail outlet using the Odoo POS system.

- Invoice Generation: The Odoo POS generates an invoice for the sale.

- Data Transmission to FBR: The Odoo FBR connector module securely transmits the invoice details to the FBR's central server.

- FBR Verification and Response: The FBR server validates the information and sends back a unique FBR invoice number and a QR code.

- Receipt Printing: The Odoo POS prints a customer receipt that includes the FBR-generated invoice number and QR code.

- Customer Verification: The customer can scan the QR code using the FBR's Tax Asaan app to verify that their purchase has been reported and the tax has been paid.

Why Choose MantechIT for Your Odoo FBR Integration?

At MantechIT, we specialize in providing tailored Odoo solutions that address the specific needs of businesses in Pakistan. Our team of experienced Odoo consultants and developers understands the complexities of FBR regulations and has a proven track record of successfully implementing FBR-compliant Odoo systems.

Our services include:

- Expert Consultation: We assess your business requirements and recommend the most suitable Odoo FBR integration strategy.

- Seamless Implementation: Our team handles the complete installation, configuration, and integration process.

- Comprehensive Training: We provide thorough training to your staff to ensure they are proficient in using the new system.

- Ongoing Support and Maintenance: We offer dedicated support to address any issues and ensure your system remains up-to-date with any changes in FBR regulations.

Ready to streamline your FBR compliance with Odoo?

Contact MantechIT today for a free consultation and discover how our Odoo FBR integration solutions can empower your business.

All Tier-1 retailers in Pakistan are legally required to integrate their POS systems with the FBR. A Tier-1 retailer is defined as:

- A retailer operating as part of a national or international chain of stores.

- A retailer located in an air-conditioned shopping mall, plaza, or center.

- A retailer whose cumulative electricity bill for the past 12 months exceeds PKR 1.2 million.

- A wholesaler-cum-retailer engaged in bulk import and supply.

- A retailer whose shop measures one thousand square feet or more.

Yes, in most cases, a specialized FBR integration module can be installed and configured with your existing Odoo ERP and POS systems. It is recommended to consult with an Odoo expert to ensure compatibility and a smooth implementation.

A robust Odoo FBR integration module will have a feature to store sales data locally and automatically sync it with the FBR server once the internet connection is restored. Many modules also allow for manual syncing of pending invoices.

The Odoo FBR integration solution can be configured to handle various sales tax rates as stipulated by the FBR for different products and services.

With the help of an experienced Odoo implementation partner like MantechIT, the integration process is streamlined and can be completed with minimal disruption to your business operations. Our team will handle the technical aspects, ensuring a seamless transition to a fully compliant system.